Searching for the best Medicare Advantage plans in Texas? Plan availability and costs are determined by the county you live in. Locate your county to discover how many plan options are available, along with costs for Medicare in Texas.

Medicare Advantage (MA) plans, also referred to as Medicare Part C, are an alternative way to get your Medicare Part A and Part B coverage. Most Medicare Advantage plans include vision coverage and dental coverage. Some plans also provide enrollees innovative benefits such as wellness and healthcare planning, reduced cost-sharing, and rewards and incentive programs. These are plan benefits that Original Medicare (Parts A & B) does not provide.

Based on your county service area, you could have a few options for Medicare Advantage plans or an overwhelming number of options—like 76 in Harris County, the home of Houston, Texas. That’s up from 55 plans in 2021. The table below highlights how many options might be available to you—depending on where you live.

Read more about the benefits of Medicare Advantage plans in Texas and when to enroll.

Medicare Advantage plans could help you control costs and have extra benefits. No wonder they are a popular choice for older Americans in Texas and across the United States. In Texas, 50% of Texans chose to enroll in a Medicare Advantage plan as of January 2023. Wondering what percentage are enrolling in a Medicare Advantage plan in your county?

In 2025, the 10 Texas counties with the highest Medicare Advantage enrollment are Starr County (71%), Hidalgo County (71%), El Paso County (70%), Willacy County (69%), Zavala County (66%), Cameron County (65%), Jim Wells County (65%), Maverick County (64%), San Patricio County (64%), and Kleberg County (63%).

These counties are all well above the national and Texas state average (50%) for Medicare Advantage plan enrollment. The table below shows the counties with the most Medicare beneficiaries, along with the population and percentage of Medicare Advantage enrollment. Scroll down to see if your county is listed.

In Texas, there are two primary types of Medicare Advantage plans; either a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). HMOs and PPOs use networks of hospitals, doctors, and other healthcare professionals.

Both plan types are available through private insurance companies that contract with Medicare. To be eligible for a Medicare Advantage HMO or PPO, you must have Medicare Part A and Part B and live in the plan’s service area. For both plans, prescription drug coverage is usually included, and plans may have preferred pharmacy networks.

Learn more about your Medicare Advantage plan options in Texas.

The lowest monthly premium for a Medicare Advantage plan is $0. In 2025, the average monthly Medicare Advantage premium for those with a premium is $8.94. That’s down from $10.68 in 2022 and $11.11 in 2021. For Medicare Advantage Prescription Drug (MAPD) plans nationwide, the premiums vary by plan type.

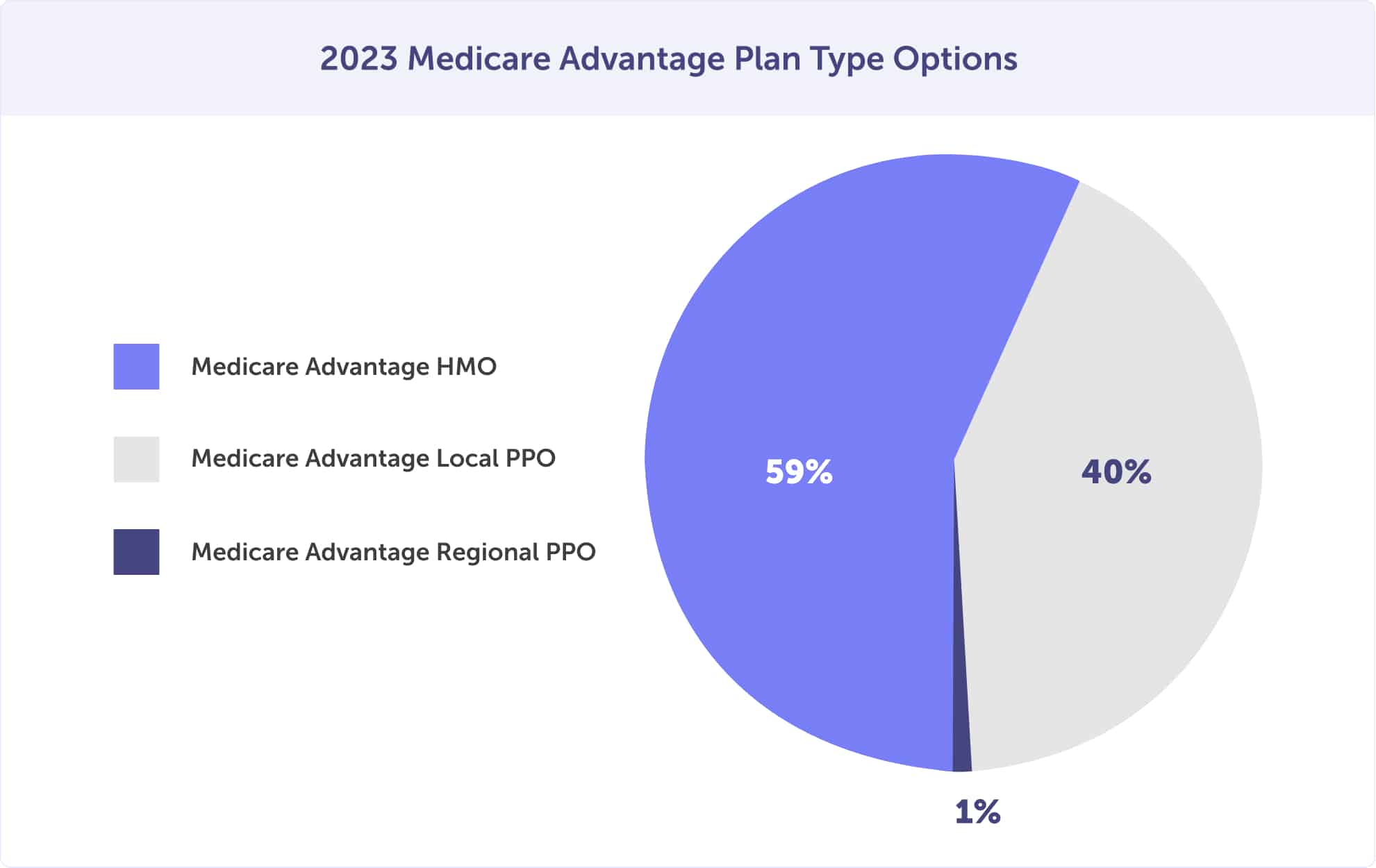

In 2020, the Kaiser Family Foundation noted that premiums average $20 per month for HMOs, $32 per month for a local PPO, and $47 per month for regional PPOs. Nearly 59% of Medicare Advantage beneficiaries enrolled in an HMO, 40% were in local PPOs, while only 1% were enrolled in regional PPO plans. Between 2022 and 2023, there was a 7% increase in local PPO options and a 4% decrease in regional PPO plan availability.

Discover the top Medicare Advantage PPO plans in Texas.

When you enroll in a Medicare Advantage or MAPD plan, you’ll be responsible for out-of-pocket costs, including premiums, health and prescription drug coverage deductibles, and copays. You’ll continue to pay your Original Medicare Part B premium to Medicare or by a monthly withdrawal from your Social Security Benefit. Medicare Advantage and MAPD premiums are paid directly to the plan provider.

Plan costs vary widely and are subject to the county where you live. Below you’ll find a table with the top 20 most populous Medicare-eligible Texas counties.

Review the table to see how many Medicare Advantage plans with a $0 premium are available in your county, the plan premium range, the annual Part D deductible range, and the maximum out-of-pocket maximum per year.

Are you not sold on a Medicare Advantage plan? Are you considering keeping Original Medicare Parts A & B but need a plan to cover the unpredictability of out-of-pocket costs? Read more about Medicare Supplement plans in Texas.

There isn’t a one-size-fits-all or “best” Medicare Advantage plan in Texas or anywhere in the U.S. If there’s a source telling you there is, they aren’t looking out for what’s best for your health and finances. Your Medicare health plan choice will come down to a mix of costs and benefits—and should be tailored to your needs.

Agent tip:

“There isn’t a one-size-fits-all or ‘best’ Medicare Advantage plan in Texas. If there’s a source telling you there is, they aren’t looking out for what’s best for your health and finances.“

If the lowest premium possible is your primary concern, then a Medicare Advantage HMO plan might be the best health insurance choice for you. Your costs are generally lower than a PPO. However, if having maximum flexibility is most important, you may choose a Medicare Advantage PPO with slightly higher costs.

While determining which is essential, you’ll also want to weigh whether maintaining existing relationships with doctors, hospitals, or other care providers is vital to your health care. You’ll want to check if your preferred healthcare providers are participating in the Medicare Advantage plan’s network before committing.

There is a lot to consider. Do you need help ensuring that you pick a plan that’s the right mix of costs and benefits or ensuring you have access to existing providers and prescriptions? Have a local Medicare agent guide you through the process.

Speak with a local Medicare agent to find a Medicare Advantage plan that’s the optimal fit for your budget and health needs. Call (623) 223-8884 or review your Medicare plan options online.

Did you know that every Medicare Advantage plan is rated annually? The Centers for Medicare & Medicaid Services (CMS) publishes Medicare Advantage (Medicare Part C) Star Ratings yearly.

The Star Rating system measures the quality of health and prescription drug services received by Medicare beneficiaries enrolled in the plans. The plans are measured by five categories, on a scale of 1 to 5—with 5 being the best: customer service, preventative care, managing chronic conditions, plan responsiveness, and member complaints, including those when leaving the plan. The Star Rating system can help narrow your Medicare plan choices.

Want to know which 5-Star rated Medicare Advantage plans are available in your county? Search for your county in 5-Star Medicare Advantage Plans in Texas.

We advise that you always search for a plan based on your health needs and budget, not because a plan received a 5-star rating from CMS. However, if there are 5-star rated plans available that fit your priorities, then you can use a 5-Star Special Enrollment Period to make a plan change.

Make sure you choose a plan that’s right for your health and budget. A local Medicare agent can help you maintain relationships with your doctors and the prescription drugs you depend on.

Call (623) 223-8884 to find the “best” plan—tailored to you. Or review your Medicare plan options online now.

2023 Medicare Advantage and Part D State State Fact Sheet.

2023 Medicare Star Ratings Fact Sheet.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

Prescription Drug Coverage – General Information.

Last updated February 8, 2023

Read more by Jasmine Alberto

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2007. I am on the the Advisory Committee for Foster Grandparents, Senior Companions, and RSVP Houston. I enjoy traveling, a backyard BBQ, and volunteering in my community.